How to set up Shopify Payments, PayPal, or a Third Party Processor on Shopify

If you're new to Shopify, then you most likely wondering how payments work. It can be a little confusing if you have never worked with a system so simple before. Shopify has their payments "Shopify Payments by Stripe," where they process the payments for you through their account with Stripe. The reason they do this is to keep revenue coming in while keeping their software plans low. If you decide to use a third-party merchant processor like Chase, Bank of America, or even PayPal, Shopify will charge an additional percentage because they are only partnered with Stripe to share the profits from the credit card percentage. So it is essential to keep this in mind when deciding which merchant processor you will use for your new store.

Using A Third-Party Processor

You can use any processor you want. Shopify has a native connection to many processors in the industry, including the well-known payment platforms like PayPal, Amazon, and Google. But if you use any third party for payments, then Shopify will charge you an additional fee that ranges between 0.5% - 2% of your revenue on the platform for those sales only.

The percentage is determined by the plan you have selected. The upgraded plans have lower percentages for third party processor payments. So check Shopify's plan and pricing page for exact percentages.

What If My Processor Isn't Listed?

In many cases, if Shopify does not build the connection, then you can use a gateway like Authorize.net, which is native to Shopify. Most payment processors connect to Authorize.net. So you would link your Authorize.net account to Shopify and your bank's merchant processing account to Authorize.net.

Using Shopify Payments by Stripe

If you use the Shopify Payments by Stripe option, then everything is built-in, simple to apply for, and there is no additional percentage. You would only have the merchant processing fee, which ranges 2.4% - 2.9% depending on which plan you have selected with Shopify. The upgraded plans have lower credit card processing fees. So pick the right plan that makes financial sense for your revenue.

Shopify payments also have a fraud meter that you will see on the order detail page in your admin. This is nice to get notifications if you have an order that is flagged for potential fraud.

How To Setup Payments

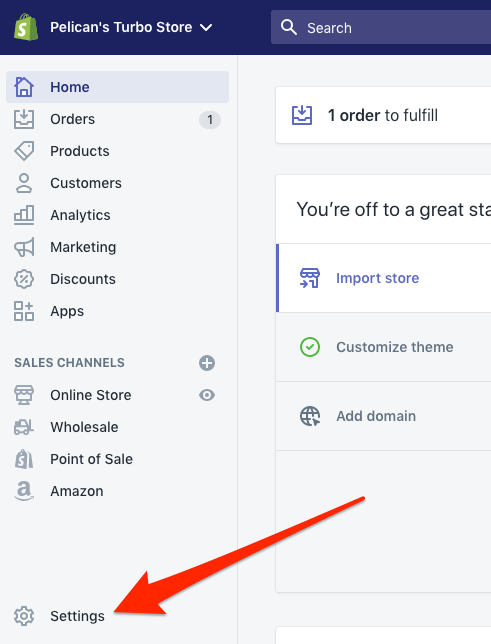

- Head on over to your Shopify admin, and in the lower-left corner of your screen, click on "Settings."

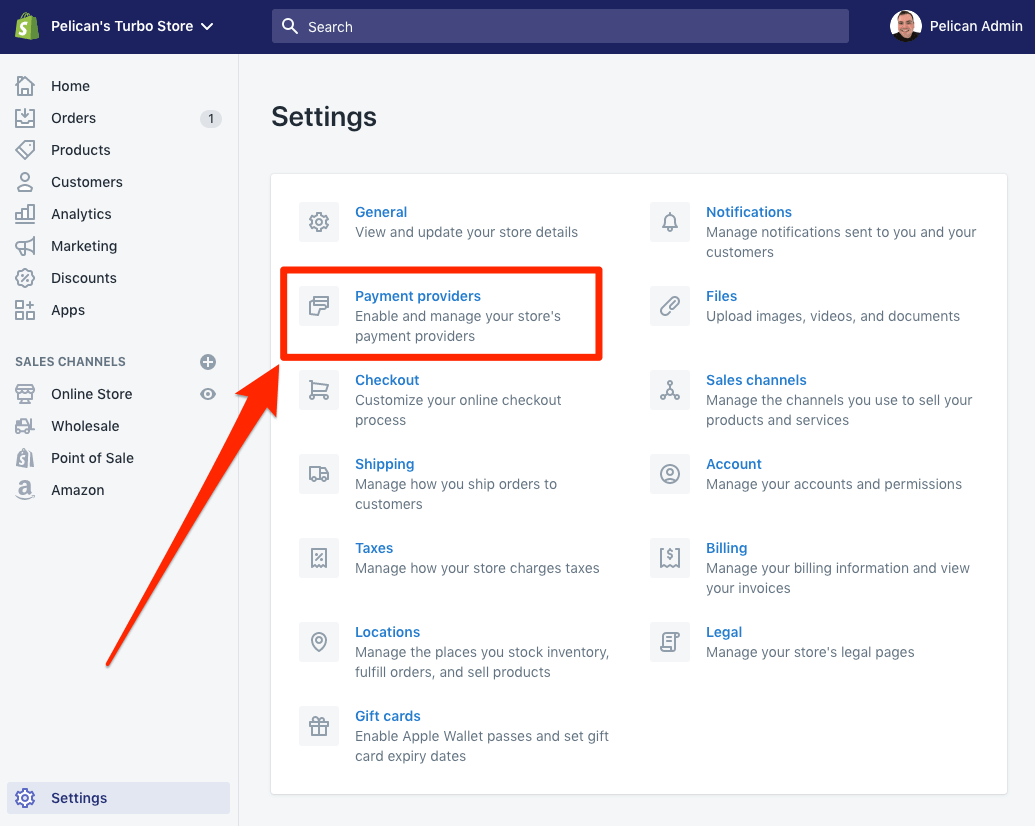

- Now that you're in the settings area, you will see many options. Click on the "Payment Providers" link.

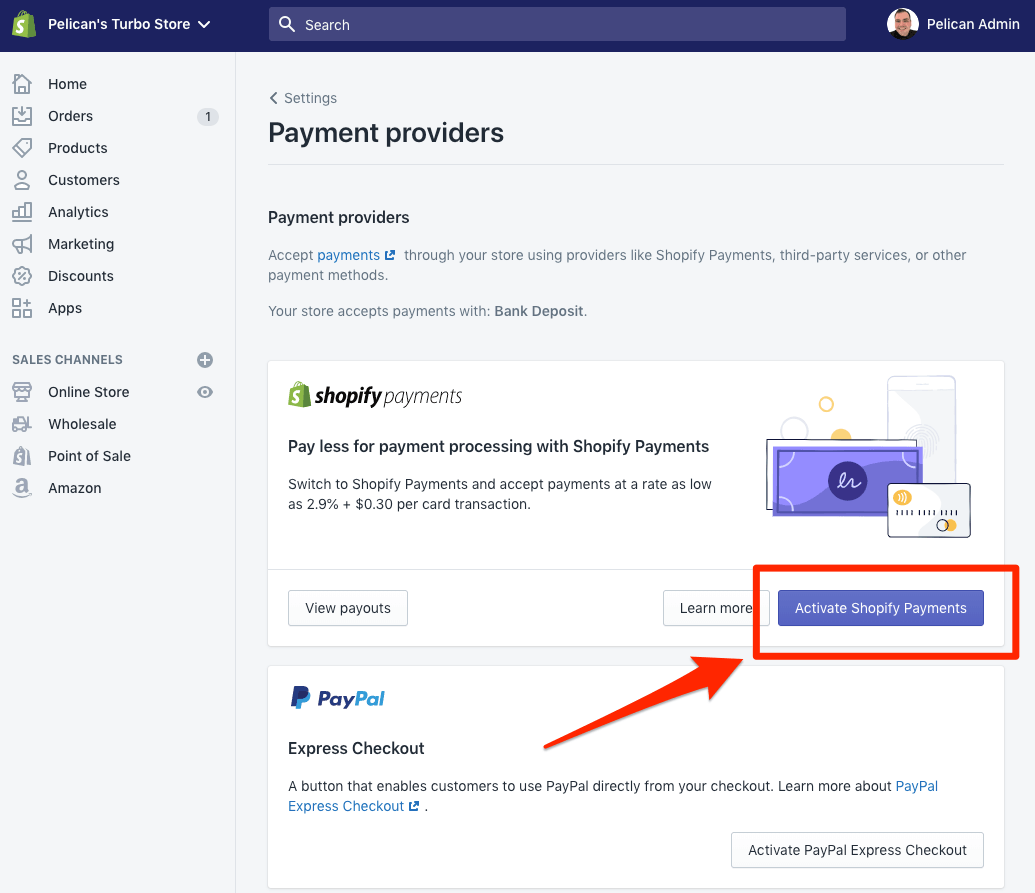

- Once you click into the payment providers area, you will see several options. If you want to set up Shopify Payments by Stripe, then click the "Activate Shopify Payments" button in the Shopify Payments area.

- If this is your first time setting up Shopify Payments, then you will see the application to apply. This is a short form that asks various information about your business and, most importantly, for your bank account information so they can deposit your payments into your business account.

- Fill out this form in its entirety and then click "Complete Account Setup."

- Once your account is set up then your payment processing will be active and available as an option at checkout for your customers. There are a few options you can change by clicking on the "Manage" button.

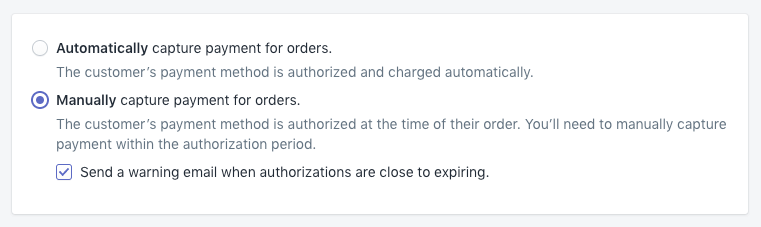

- Lastly, scroll to the bottom of the payment providers screen, and you will have the option to authorize and capture each payment automatically or to capture each payment that is processed manually. When done, click the save button.

Follow the same instructions above to activate PayPal and even your merchant processor. Shopify offers dozens of options, including BitCoin, Amazon, PayPal, Google. Authorize.net, custom payment options, and more.

If you have any questions, then reach out to one of our project managers today. Since payment information activation requires sensitive information to be filled out, or in the case of PayPal and other third party platforms, they require confidential login information, we prefer for our clients to handle this short process themselves. If you need help, then we're always a phone call away!